Venture capital funding for companies competing in the smart grid sector during Q2 2013 was not on track to rival the backing that the industry received in 2012. Ten deals were sealed during the second quarter, totaling an unremarkable $50 million; as compared to nine during Q1, which brought in a tidy sum of $62 million.

Looking at the technologies that were awarded the most funding during Q2, smart grid communications led the pack, followed by home and building automation, grid optimization, advanced metering infrastructure and security.

By contrast, during 2012, smart grid funding came in at an annual $434 million, dispersed over 40 deals, according to the report, “Smart Grid Funding and M&A: 2013 Second Quarter,” just released by Mercom Capital Group, a clean energy communications and consulting firm with offices in Austin, Texas, and Bangalore, India.

.jpg)

“Even though the number of deals [was] consistent compared to the last few quarters, this was one of the lowest funding quarters in the last four years,” commented Raj Prabhu, CEO of Mercom Capital Group. Except for one quarter, Q3 2012, VC funding has been stuck in the $50 million to $70 million range per quarter for nearly two years, he explained.

Venture funding in smart grid companies was at its highest levels between Q4 2009 and Q2 of 2011, right after the U.S. Department of Energy announced stimulus grants for smart grid and smart meter infrastructure.

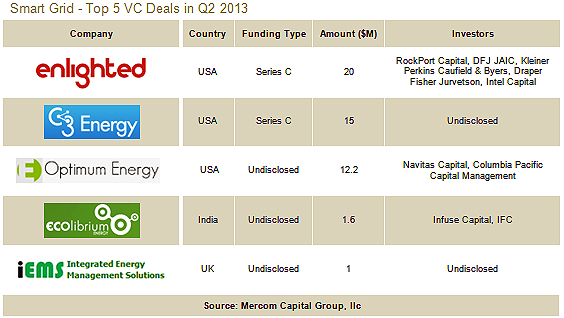

Specifically, the top f VC deals during the second quarter included:

- $20 million raised by Enlighten—a Petaluma, Calif.-based software manufacture—from RockPort Capital, DFJ JAIC, Kleiner Perkins Caufield & Byers, Draper Fisher Jurvetson and Intel Capital;

- $15 million raised by C3 Energy–a Redwood City, Calif.-based provider of smart grid analytics SaaS (News

- Alert) solutions— from undisclosed investors;

- Alert) solutions— from undisclosed investors;

- $12.2 million raised by Optimum Energy—a Seattle, Wash.-based provider of provider of enterprise optimization solutions— from Navitas Capital and Columbia Pacific Capital Management;

- $1.6 million raised by Ecolibrium Energy –a Gujarat, India-based provider of energy management solutions—from Infuse Ventures and International Finance Corporation (IFC); and

- $1million raised by Integrated Energy Management Solutions —a Scarborough, England-based provider of energy management solutions—from undisclosed investors.

Consolidations

In related news, Mercom found that there were three merger and acquisition (M&A) transactions during Q2 2013. Only one transaction was disclosed for a resulting total of $107 million. Last quarter, there were four transactions, of which only one was disclosed for $11 million. Cumulatively, during the year 2012, there were 23 transactions valued at $17 billion.

The report cited the following as the largest M&A transactions by dollar amount during Q2 2013 (both disclosed and undisclosed):

- $107 million—Networking equipment giant Cisco (News

- Alert) (San Jose, Calif.) acquired JouleX (Atlanta), an enterprise and energy management company;

- Alert) (San Jose, Calif.) acquired JouleX (Atlanta), an enterprise and energy management company;

- Undisclosed amount—Alarm.com (Vienna, Va.), a provider of interactive security and connected home services, acquired EnergyHub (New York City), a provider of home energy management software and systems for undisclosed amount; and

- Smart thermostat maker Nest (Palo Alto (News - Alert), Calif.) acquired energy data startup MyEnergy (Boston), an online service that allows people to gather all of their utility usage and bills in one place, to compare with friends and family.

Edited by

Alisen Downey